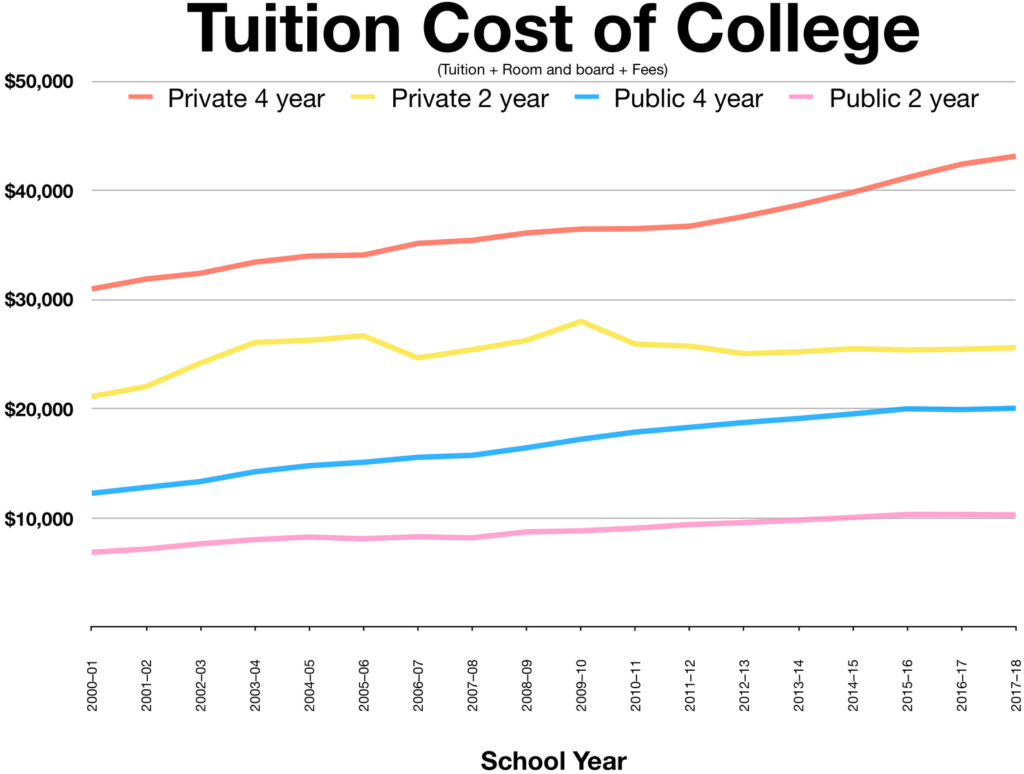

40k, 60k, 80k, 100k-- these are completely “normal” price points for universities. The sticker price for most four-year universities would make anyone balk; the average person doesn’t have an easy $160,000 in their pocket ready to be spent on a bachelor’s degree.

However in reality, a very minute percentage of students actually end up paying full price.

83.3 percent of first time students receive some kind of financial aid.

How do so many students get money for college? There are actually less steps toward financial aid than you probably think.

It begins with the FAFSA (Free Application for Federal Student Aid), a government form that collects a slew of personal and parental information that is meant to help schools and the government calculate the “right” amount of aid you’ll need.

Upon completion of the FAFSA, you’re able to send it to schools you have applied to or plan to apply to-- after that, it’s all about applying and getting accepted; the easy part is done!

Upon getting accepted, a school will eventually push out their aid decisions, some quicker than others.

When you get the numbers, you’ll be able to decide whether or not it’s financially feasible to attend that school!

On average, a student will borrow around $11,000 in loans a year when they go to school. What happens to the other $29,000 dollars needed to cover expenses?

Some of that money can come from grants from the school and government, or scholarships, and the school will likely also expect that you contribute some money out-of-pocket-- or rather, they expect your family to.

Of course, none of this is guaranteed.

How your aid will be distributed depends on a great number of factors-- you could end up with more or less than $11,000 in loans, varying expected family contribution, a ton of grants, or only a few.

There are a few different types of loans:

- Direct subsidized loans: loans on which the government pays the interest while you’re in school.

- Direct unsubsidized loans: loans on which the student is responsible for paying interest at all times.

- PLUS loans: loans available to both parents and students; these will have higher interest rates and require a credit check.

You’ll likely receive a healthy mixture of these types of loans, and it’s up to you and your parents to decide if it’s a good idea to take the plunge.

So don’t let giant tuition prices deter you from applying to the schools of your choice! Even in this confusing system where the cost of education has gone up exponentially, help is available!